Last week the Federal Reserve cut interest rates by 0.25% and signaled openness to further reductions. What does this mean for your investments?

For Your Savings: Bank accounts, Certificates of Deposit (CDs), money market funds

- Savings accounts: The interest you earn declines as rates fall. Even accounts that once offered “high yields” may become less competitive.

- New CDs: Future CD offers will likely have lower rates than what you’ve seen recently. If you locked in a higher rate earlier, you keep that rate until your CD matures.

- Existing CDs: Your rate doesn’t change during the term. Only when the CD matures and you reinvest will you face the new, lower rates. Check your CDs to see if you have “auto-roll” turned on. Auto-roll is a feature some banks and brokerages offer that automatically reinvests your CD when it matures. Instead of the funds moving into cash, the principal (and sometimes the interest) is rolled into a new CD of the same term at the then-current, and now lower, market rate. Auto-roll is a convenient feature for many, but in a declining rate environment it prevents you from being able to seek out the best interest rate.’

- Money market accounts/funds: Money market accounts and money market mutual funds usually track short-term interest rates and often invest in instruments such as U.S treasuries, so their yields often decrease after a rate cut.

For Bonds:

Bond prices and interest rates are inversely related. Meaning that rate cuts generally push bond prices up.

- Existing, higher coupon bonds become more valuable.

If you’re holding a bond paying 5% and new bonds are only offering 4% after a rate cut, your bond’s higher coupon becomes more attractive. Investors are willing to pay more for it, which drives up its price. - Longer-term bonds typically react more.

The farther a bond is from maturity, the more sensitive its price is to changes in interest rates. So a 10-year bond usually sees a bigger price change than a 1-year bond when rates move.

For Stocks:

When the Federal Reserve cuts interest rates, it lowers the cost of borrowing throughout the economy. This can influence stocks in several ways:

- Cheaper borrowing = higher profits.

Lower rates reduce borrowing costs for businesses. Companies can finance projects, refinance debt, or expand more cheaply, which can boost future earnings. - More attractive than bonds.

As interest rates fall, yields on savings accounts and bonds decline. Investors often shift money toward stocks in search of higher returns, increasing demand for equities.

It is not linear that rate cuts are supportive for stocks. Rate cuts usually happen because economic growth is slowing or risks are rising. If investors fear a recession, stock prices can still fall even as rates drop. The market weighs both factors when pricing equities in response to cuts.

The Importance of Real Return

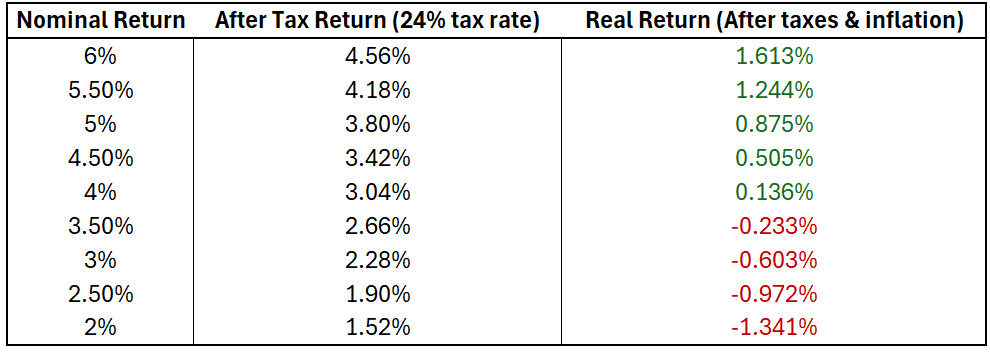

Real return is the return on your investment after accounting for taxes and inflation. We encourage investors to pay attention to their real return to make sure they’re protecting the purchasing power of their assets. We created this table below to illustrate the impact of taxes and inflation. We used a 24% tax rate and 2.9% inflation, which was the most recent CPI number.

You can see that taxes and inflation eat away heavily at returns. Make sure to pay attention to this relationship when weighing investment opportunities in a declining rate environment.

Questions on how to protect the purchasing power of your assets for your individual circumstances? Feel free to reach out to us.

Richard Mundinger, CFA

richard@rmhinvestment.com

520-314-2300

Ashlyn Tucker, M. Fin, passed CFA Level III exam

ashlyn@rmhinvestment.com