As we look ahead to 2026, long-term investment success will be shaped less by short-term market noise and more by long-term, structural trends. Today we are highlighting four themes we believe will continue to influence opportunities and risks in 2026 and the years ahead.

Demographics

The United States, and many other countries around the world, are experiencing the social and economic impacts of an aging population. We have increasing life expectancy coupled with concerns around the safety and reserve amounts in Social Security and Medicare. We will likely see people work longer, retire later, and adopt different retirement saving and income strategies. We will also need more medical innovations and services to support an aging population.

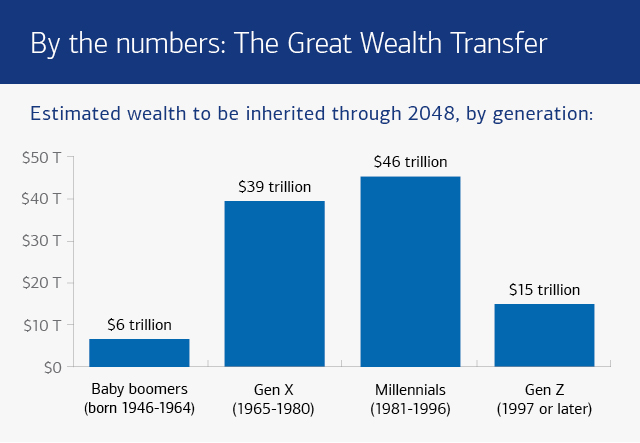

There is also a demographic impact on wealth concentration and spending. Baby Boomers, the generation born between 1946-1964, are estimated to account for a little over half of the United States’ total household wealth, worth around $80 trillion (Michigan Journal of Economics, 2025). For a reference point of how significant $80 trillion is, the U.S. nominal GDP in 2024 was approximately $29 trillion.

This leads us to a phenomenom called “The Great Wealth Transfer”. Over the next few decades, that $80+ trillion is expected to change hands to spouses and beneficiaries, creating an unprecedentedly large shift of wealth in the population. The younger generations need to be well-prepared to properly handle this windfall.

A couple other facts we found interesting related to demographics themes in the economy:

- The median age of first-time home buyers is 40 years old. Median age of all home buyers is 59 years old. (National Association of Realtors, 2025).

- 31% of household wealth is owned by people over 70 years old (Apollo, 2025)

Growth of Private Markets

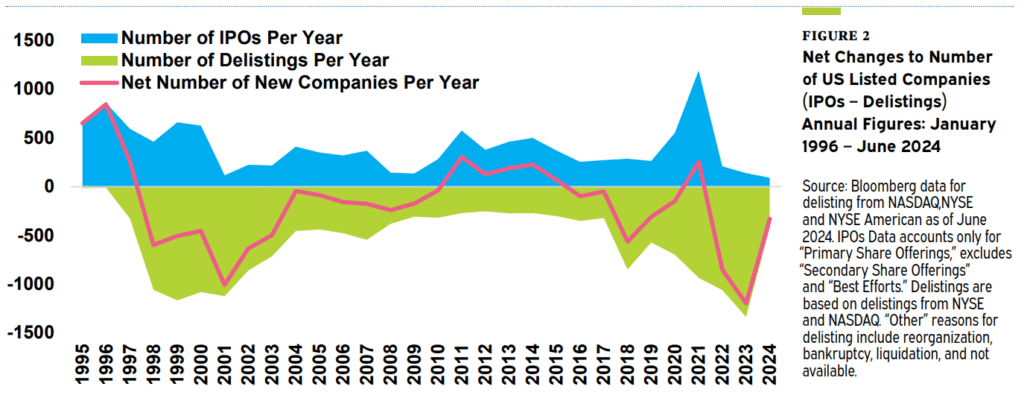

The US had over 7,000 publicly traded companies at its peak in the 1990s, now the number of publicly traded companies fluctuates in the 4,000s.

The decrease in publicly traded companies has been driven by factors such as regulatory requirements and costs of being publicly traded, mergers and acquisitions taking companies private, public market concentration, and an increase in the amount of available private capital.

IPO activity accelerated in 2021 due to low interest rates, high liquidity, and a large number of SPACs. The net number of new public companies has declined since then.

The decreasing number of public companies has prompted investors to seek diversification in alternative investments (private credit, private equity, real estate, etc). We expect to see continued growth and interest in alternative investments from retail investors.

Artificial Intelligence

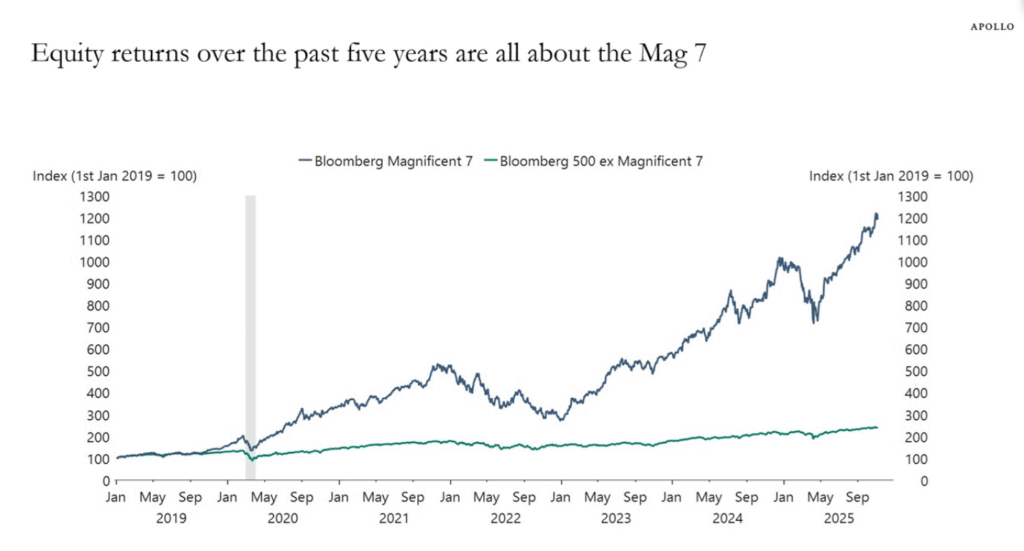

The Magnificent 7 (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) led the stock market to record highs this year. The chart below shows the Mag 7 performance compared to the Bloomberg 500 exlcuding the Mag 7. The chart shows just how significant the returns of these 7 stocks have been compared to the broader market.

We believe these companies will still continue to be successful in 2026, but the question is at what pace and magnitude is their growth rate sustainable at? Investor sentiment continues to express nervousness around the market share and stability of these companies.

The returns have been so significant on some of these stocks that many investors have much larger than anticipated portions of their portfolio held in these companies. We will not be surprised if we see some downward pressure on their stock prices from large investors taking some profits and as they try and diversify and reallocate from these top tech stocks.

Whether people like it or not, AI is here to stay and its growth story and thesis will continue. We aren’t saying their won’t be a correction in the interim, but the narrative is a long-term one.

We encourage investors to stay focused on earnings quality and be mindful of leverage and concentration risk. And to maintain a well-diversified investment strategy in their non-technology investments.

Energy Infrastructure & Supply

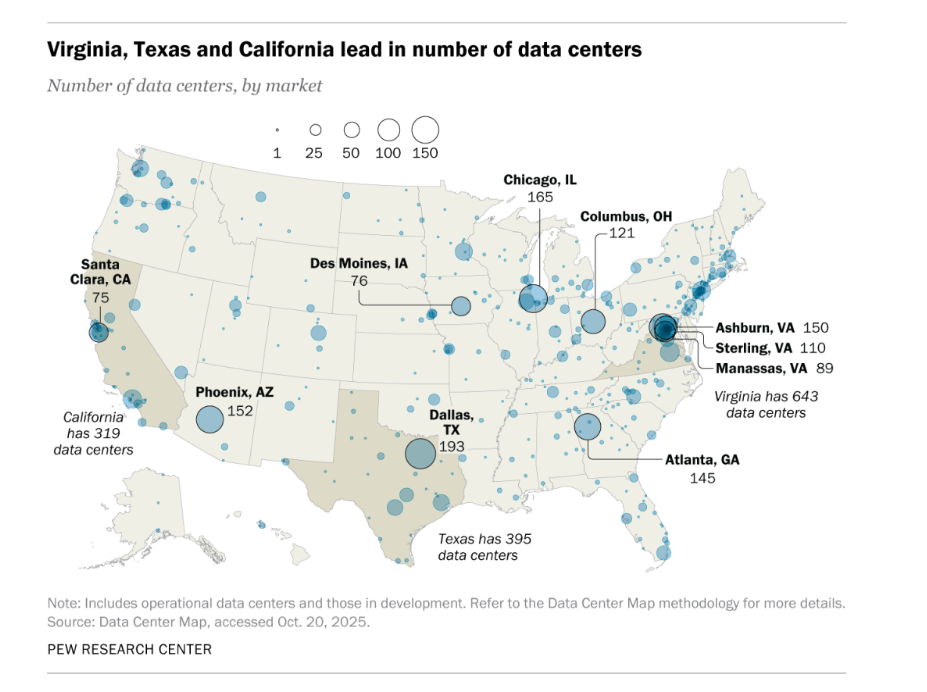

Energy supply has always been a discussion, but it has been brought more to forefront with the conversations around electrification and data centers.

In 2024, US data centers consumed 4% of the United States’ energy usage (Pew Research, 2025). At the individual consumer level, there are concerns for how the data center demand for energy will impact their energy bills. The data centers will need to continue to invest in their own energy supply and infrastructure to minimize their strain and negative impact on their local grids.

Natural gas is currently the main source for data center electricity at 40%, followed by renewables (solar and wind), nuclear, and coal (IEA). Nuclear is expected to become a bigger proportion of the energy source as tech companies work with energy companies to commission and develop small modular reactors (SMRs).

We are starting to see the build out of more nuclear infrastructure and a result, a significant increase in the demand for uranium. In October, the U.S. government signed a deal with Westinghouse Electric that targest building $80 billion in nuclear reactors (Reuters, 2025). With growing demand for energy across both consumers and corporations, we are not surprised to see the rush to nuclear power.

These themes are not about predicting the next market move, but about understanding the longer-term forces shaping the investment landscape. As always, our focus remains on building diversified portfolios aligned with your goals, time horizon, and risk tolerance.

Thanks for reading and have a happy New Year.

Richard Mundinger, CFA

richard@rmhinvestment.com

520-314-2300

Ashlyn Tucker, M. Fin

ashlyn@rmhinvestment.com