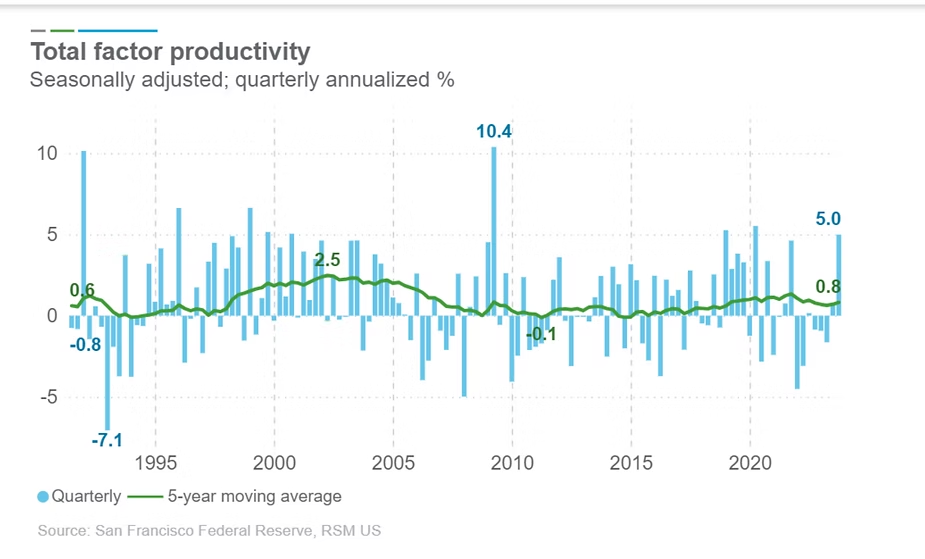

Total factor productivity (TFP) is an economic measurement that reflects the residual growth of productivity that cannot be directly attributed to increases in labor or capital. Instead, it helps indicate the growth in productivity driven by technology or economic structural changes.

As you can see in the chart below, the TFP moving average trendline has been very low and flat since declining post 2005. However, in Q4 of 2023, the San Francisco Federal Reserve measured the utilization adjusted TFP to be 4.99% (rounded to 5% in blue on the far right of the graph). In Q3 it was 0.76% and prior to that, it was negative for multiple quarters in a row.

Could this be an indicator that the investments businesses have been making over the last couple of years are now causing material changes? Is the U.S. heading into a productivity renaissance like the one we experienced between 1995-2004? The answer is far more nuanced than one economic measurement, but we do believe it is worth examining some of the impacts we see technology making on the economy.

Technology

Technology is constantly evolving in many ways, but we will focus on artificial intelligence (AI) as it is one of the most significant technological developments affecting companies.

Here are four broad categories to classify some of the big picture ways we view AI impacting our world:

- Enhancement: AI can be a great tool that helps human workers do their jobs at a higher quality, more efficient level.

- Creation: AI will create new jobs that did not exist before.

- Displacement: AI can and will replace some of the tasks done by humans and cause job losses in certain fields.

- Security/safety: As AI and its capabilities continue to evolve, regulations will need to as well. Scams where AI impersonates a human’s voice, appearance, and mannerisms already exist and are just one example of many possible concerns related to AI.

Even though we broke out these elements into four separate categories, the real questions and future implications lie in how they interact together

Here is an example: Waymo, the Google self-driving car project, could enhance a working professional’s time management by allowing them to eat, nap, work, etc on their commute instead of having to drive the vehicle. Waymo, or equivalent self-driving technology, will also displace jobs from taxi drivers, Uber drivers, bus drivers, truck drivers, and so on. Self-driving technology will also create new jobs for people who develop the technology for the car, liability and insurance management, rider experience, marketing jobs for self-driving vehicle brands, lawyers specializing in self-driving car accidents, and more. There will be unemployment frictions during this industry evolution as a taxi driver does not have the skills or education to quickly switch jobs self-driving vehicle liability management. We cannot view job deletion and creation during this technology transformation as a one-for-one substitution. And finally for this example, a major concern in relation to self-driving cars is safety. Self-driving vehicles are still novel to us as a society, and we do not have large enough sample sizes of data on their risks, malfunctions, and accident probabilities to fully embrace them everywhere.

This is just one example of how interrelated the implications of AI are on the economy and how there are a wide variety of scenarios for how it will all play out in the future. In aggregate, we expect AI related developments to bolster the overall macro economy by enhancing productivity and reducing costs in the long-term. Large corporations will be able to leverage their resources to use technology as a tool to improve profit margins and bolster stock prices. However, there will be costs and frictions along the way.

Human Capital

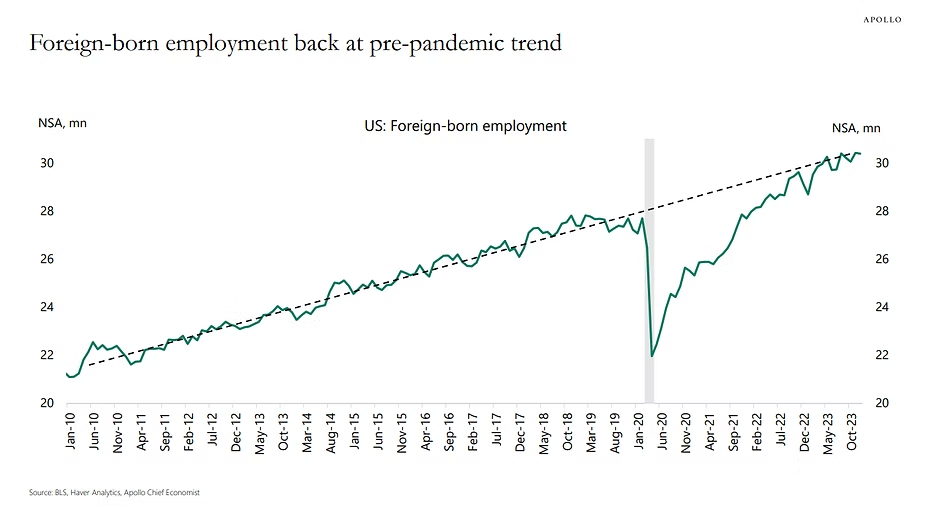

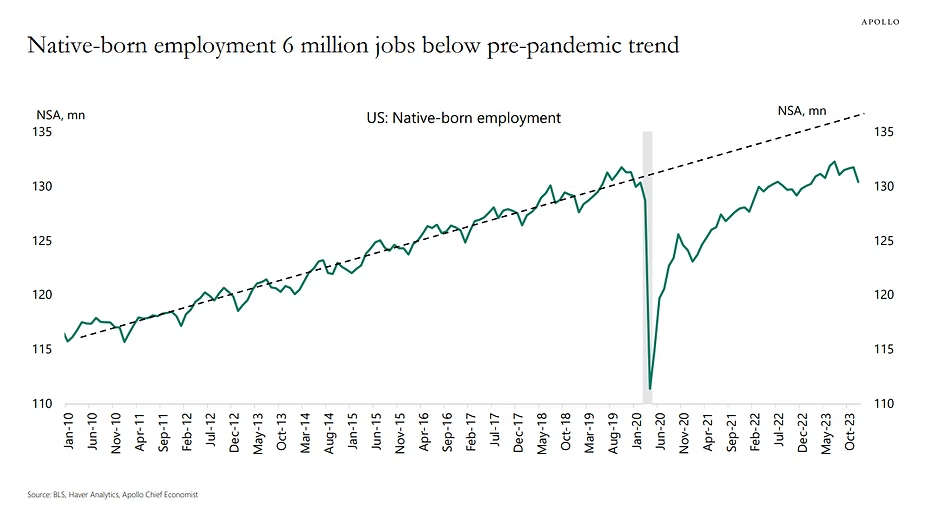

Another noteworthy data point we saw in early 2024 is that foreign-born employment in the US is back at pre-pandemic levels but native-born employment is still 6 million jobs below pre-pandemic level.

Where are all the missing native-born workers? That’s a nuanced question to answer. U.S. macroeconomic data this year has shown wage inflation and labor shortages. However, from anecdotes of people we’ve talked to, they are struggling to find or switch jobs and they have not had salary increases that they feel match inflation.

We do not have the answer for why there seems to be these mismatched stories on the labor market and missing workers, but we do have a few hypotheses. It’s possible that there is a mismatch between the type of jobs that need to be filled and the desires and qualifications of job-seeking individuals. A simple example is that someone recently laid off from a tech company is likely unwilling to take an hourly wage job in foodservice. I’m sure we’ve all seen and been at restaurants that are still short-staffed. Let’s say they do take a temporary job in foodservice; they would then be considered underemployed as their work doesn’t make full use of their qualifications and abilities. You can see that the relationship between unemployment and job openings is not simple one-for-one math. The information we’re missing in all of it is worker ages, desires, qualifications, locations, family dynamics, and so much more…which is all very hard to capture cleanly in data.

We thank you all for taking the time and reading “Market Watch.” It is meant as an educational piece on the always evolving markets. It is something we plan on providing every month, and your feedback is very important to us.

On a personal note, RMH is now in the position to bring on new clients so please be sure to share this informational letter with whomever you wish. RMH’s focus is on the customizable investment needs of individuals, families, and foundations. We enjoy working with our clients to better understand their goals, values, and passions for what is important in their lives. In expanding our client base, we look forward to working with people who share these same desires.

Ashlyn Tucker, M. Fin., Analyst

Richard Mundinger, CFA

Sources: