What do tennis and investing have in common?

Success is achieved by making less unforced errors than others. And by doing so over long periods of time with discipline, consistency, and managing emotions.

The top 0.01% of tennis players (or maybe even less) play the game by winning points. They serve aces, paint the lines, and target their opponent’s weaknesses.

The rest of us 99.99% play by trying not to lose points. We double fault, hit the ball out of bounds, hit it into the net, or swing and miss entirely. Our best strategy to win is to focus less on hitting winners and more on avoiding unforced errors.

This is analogous to investing. There may be a few people in the world that are good at (or at least claim to be good at) “winning” extra points by market timing, day trading, and stock picking. But for the majority of us, we can successfully amass wealth from investing by avoiding unforced errors and being disciplined over time.

You may ask, what are unforced errors in the context of investing? Unforced errors in investing include things such as:

- Trading too much: Even though trading is usually “free” in the modern world, there are still costs that you do not see such as bid-ask spreads, execution cost, market impact, and opportunity costs.

- Not being aware of tax impacts: Trading too often in taxable accounts can also result in extra capital gains taxes. Being strategic about what positions you hold and what actions you take in taxable compared to tax-deferred accounts can bolster investment growth over time.

- Selling out of the market: buying and selling into and out of the market is not an investment strategy. It is gambling on two points in time.

- Overhauling and changing things too often: Change over time will be a part of a good investment strategy, but it should be incorporated slowly and tactfully over time. Any time you totally shift your strategy, change brokerages, or switch advisors, there will be switching costs.

- Not being aware of your biases: We all have them and we will never be able to fully eliminate them. We can work to be aware of them and not let them interfere with our investment decisions.

- Listening to the talking heads on TV: Or the ones on the Internet. Or your neighbor down the street. They do not know your income, savings, risk tolerance, time horizon, tax bracket, and goals. There is no one-size fits all approach to investing.

Roger Federer. Rafael Nadal. Novak Djokovic. Three of the most dominant male tennis players of all time.

All three of them share a stat of winning just 54% of the total points in their careers (ATP Tour: Federer, Nadal, Djokovic). They built championship careers while still losing 46% of the points they played. Small margins can compound over time and result in consistent success.

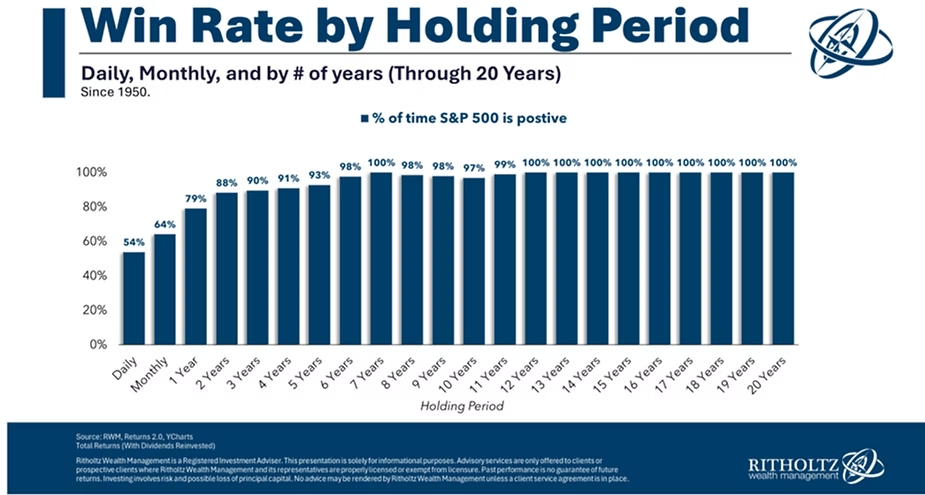

We included the chart below in our last Market Watch and are sharing it here again as well. Historically, 54% of the time, the total return of the S&P 500 for a one-day holding period has been positive. 79% of the time, the total return for a one-year holding period has been positive. 97% of the time, the total return for a 10-year holding period has been positive. Once again, small winning margins over time that compound significantly.

This week, we received an email newsletter from DataTrek Research and here is a paragraph that sums up our thoughts concisely:

“Takeaway: Everything in life, and therefore investing, is about accurately framing problems and then implementing solutions. The last month has been the most exhausting stock market “correction” I can recall. So many uncertainties, so few answers, and things could certainly get worse before they get better. However, we know it takes a sharp shock, not just an annoying drip of negative news, to truly kill a bull market. While another 5-10 percent decline is entirely possible, we don’t think that is too heavy a price to pay for continued exposure to US equities over the longer term.” – Quoted from Nicolas Colas & Jessica Rabe of DataTrek Research

We thank you all for taking the time and reading “Market Watch.” It is meant as an educational piece on the always evolving markets. It is something we plan on providing every month, and your feedback is very important to us.

On a personal note, RMH is now in the position to bring on new clients so please be sure to share this informational letter with whomever you wish. RMH’s focus is on the customizable investment needs of individuals, families, and foundations. We enjoy working with our clients to better understand their goals, values, and passions for what is important in their lives. In expanding our client base, we look forward to working with people who share these same desires.

Ashlyn Tucker, M. Fin, Analyst, CFA Level III Candidate

Richard Mundinger, CFA