One of the most common questions in the investing world: What stock(s) should I buy?

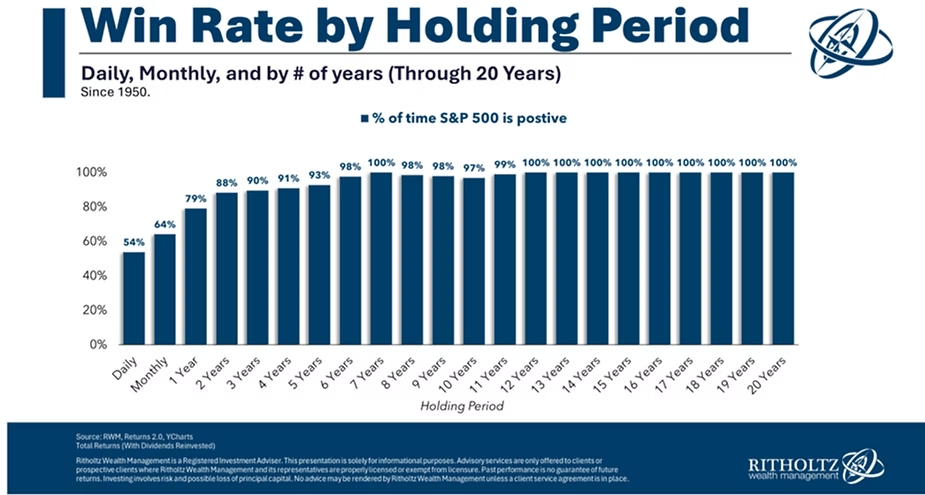

Our answer would vary from person to person. Why is that? It’s because everyone’s time horizon is different.

Ask ten different people what long-term means and you’ll get ten different answers. To us, we view time horizon as the period you plan to hold an investment before needing the funds.

For a 25-year-old looking to invest for retirement, long-term may mean 40 years. For a 63-year-old looking to retire, long-term may be less than five years. If you’re a trader, it may mean less than a week.

Time horizon is the length of time you expect to hold an investment before needing to access the money. We believe it’s the most under-discussed piece of investing. But it might be the most important.

Time horizon shapes your risk tolerance, asset allocation, and emotional resilience. It’s the foundation for every financial decision.

We think of time horizons in three buckets.

- Short-term: Emergency fund, cash, vacation, down payment, near-term spending.

- Medium-term: Home purchase, kid’s education, career pivot.

- Long-term: Retirement, legacy, generational wealth.

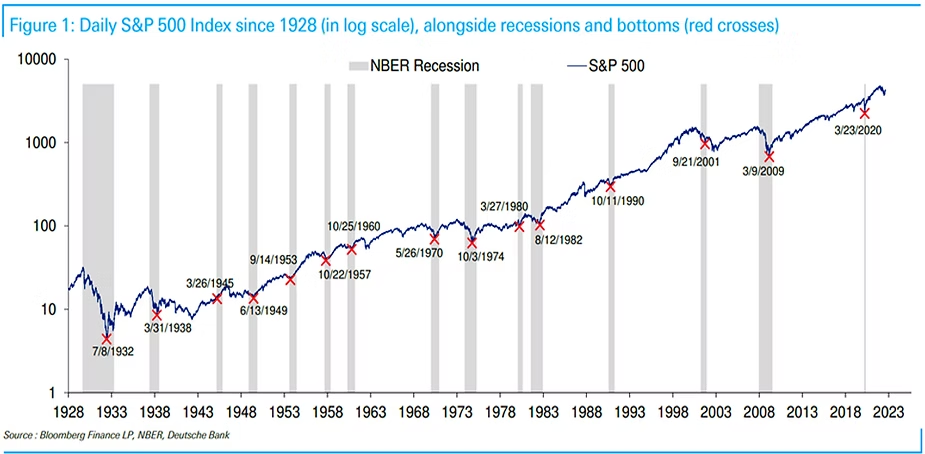

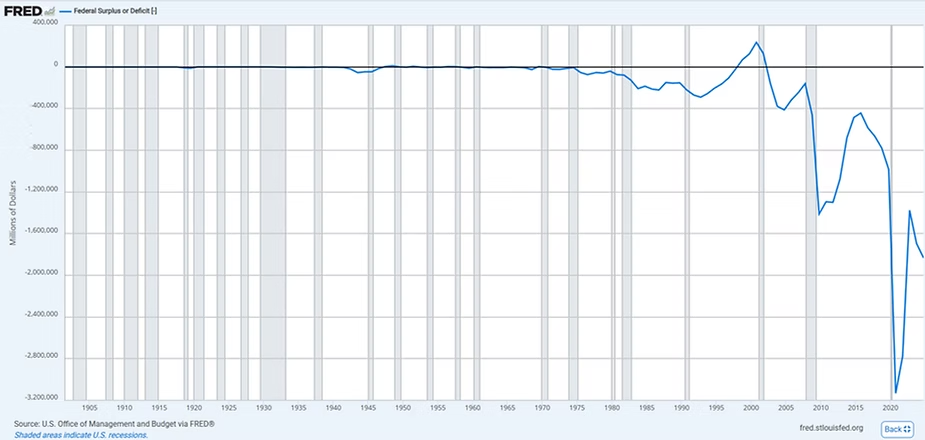

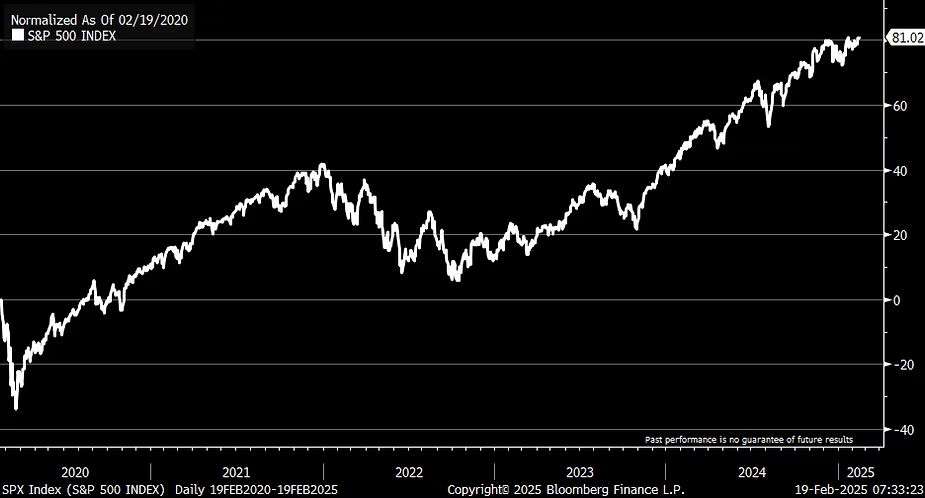

For instance, it doesn’t matter if the stock market is up or down this year. What matters is when you need the money. If you’re investing for a home purchase in one year, a market drawdown is a much bigger problem than if you’re investing for retirement in two decades.

Investment portfolio construction, stock picks, and investment advice is not a one size fits all. The questions isn’t, “What should I invest in?” it’s “When do I need this money?”. That one question can change everything.

Your time horizon is your time horizon. It is likely different than mine. Different from your friends, your neighbors, and your family. The next time you’re arguing about an investment with someone, remember that almost everyone you’re arguing with has a different time horizon than you.

The news media’s investment advice often misses the mark because it doesn’t account for your unique time horizon. While you are saving and investing for your unique goals, the media is focused on generating buzz to keep advertisers happy and engaging viewers with hot stocks and trends.

This disconnect highlights why blanket recommendations fail. Your time horizon should shape your risk tolerance and asset choices, making personalized planning around “when you need the money” far more critical than following media-driven noise.

What stock should you buy? The right answer will be: it all depends on your time horizon.

RMH is in the position to bring on new clients so please be sure to share this informational letter with whomever you wish. RMH’s focus is on the customizable investment needs of individuals, families, and foundations. We enjoy working with our clients to better understand their goals, values, and passions for what is important in their lives. In expanding our client base, we look forward to working with people who share these same desires.

We thank you all for taking the time and reading “Market Watch.” It is meant as an educational piece on the always evolving markets. It is something we plan on providing every month, and your feedback is very important to us.

Richard Mundinger, CFA

520-314-2300

Ashlyn Tucker, M. Fin, passed CFA Level III exam

Leave a Reply